8th Grade Student Enterprises and Double-entry Bookkeeping

Oliver van der Waerden, Rudolf Steiner School Kreuzlingen

The following text is based on the “Curriculum for Economics - from Year 1 to Year 9”, which was published in spring 2023 by the Association of Rudolf Steiner Schools in Switzerland and Liechtenstein. The curriculum is freely available for download in German, French and Italian at the following address:

www.steinerschule.ch/lehrplan.

Portuguese and Spanish translations are available at: www.associative-financial-literacy.com/resources.

This article describes a one-year student company project, combined with lessons in double-entry bookkeeping, and explains why it makes sense to establish such lessons in the 8th grade (or lower secondary level).

The student company project grew out of the circumstances of the class at the time and should only serve as an example here. Lessons in double-entry bookkeeping also have their value independently of this, but of course it becomes more attractive due to the practical connection.

Why double-entry bookkeeping?

In double-entry bookkeeping, all forms of assets and debts, on the one hand, and income and expenditure, on the other, are sensibly structured and related to each other. The balance sheet, which is drawn up at a certain point in time, shows the relationships as in a stationary picture, whereas the income statement (the difference between income and expenditure) shows processes within a certain period of time. This double representation depicts the money flows of an institution with its internal and external effects in a comprehensive and structured manner. For a few centuries now, double-entry bookkeeping has therefore become the "language of business life" worldwide, in which those involved can clearly communicate across cultural and linguistic boundaries.

The way to the project

In the 8th grade, money is raised at our school by the students for their joint graduation trip. The idea arose to combine Steiner's suggestion that accounting should be carried out before the 15th year of life with the bookkeeping lessons. For this purpose, small student company was founded, accompanied and recorded from an accounting perspective throughout its existence from opening to liquidation. This was not about setting up an early commercial training, but simply about the motto: "I am human and nothing human is alien to me!"

For those who are not yet familiar with double-entry bookkeeping, much teaching material and many online courses are too specific and user-unfriendly. It is advisable to work through a book such as a book such as Bookkeeping in 20 hours. Here the technical basics are presented briefly, and in a generally understandable and comprehensive manner. The book suffices well as a tool for the class teacher!

Preparation of the class

First of all, an understanding of the balance sheet was developed, in which the assets of a person or institution (cash, account balances, inventories, means of production, intangible assets, etc.) are set alongside their liabilities (outstanding invoices, loans, mortgage debts, etc.). Equity (or own capital) is also on the liabilities side. It expresses what proportion of the assets I myself am entitled to. (The fact that equity appears on the ‘debit side’ was a tough nut to crack for some of the students!)

People also take stock of their lives from time to time, certainly at the end. What did I bring with me? What was given to me? What have others contributed to my life? What remains? It becomes noticeable that the balance sheet is less about external success or failure, but that it touches on questions that can also concern a young person in the depths of his soul: “Who am I? What I want?"

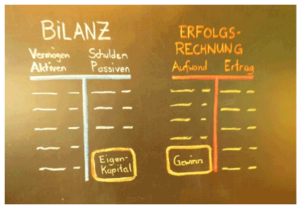

In its classic presentation, the balance sheet was treated as a T-account (see blackboard illustration). It thus conveys within it the image of the scales (bilancia, balance), the equilibrium between assets (Aktiven) and liabilities (Passiven). This can be an advantage for understanding compared to the vertical format that is widespread in business today. Incidentally, it can also be instructive for adults to draw up their own balance sheet for a purely economic point of view. What economic values do I have at all? Who do I have economic obligations to? Or does my life mainly consist of expenses and income, so that I have a rather small "balance sheet total"?

The income statement, the second part of the bookkeeping, was not specially prepared because the nature of it is more familiar to the students (milk booklet invoice, bank account statement, etc.). The only thing that was new for most of them was the form of the T-account. (See image of a student notebook.)

Then various imaginary companies (baker, bicycle dealer, stone grinder) were run through for accounting purposes. The business cases presented were chosen in such a way that the start-up impulse, capital procurement, type of income and expenditure, use and formation of equity (own capital), various forms of asset accumulation and depreciation (used-up value) became comprehensible.

Even with these "theoretical" companies, it was noticeable how the skills and intentions of the company founder are shown in his/her balance sheet, while his/her active relationship to the social environment is more likely to be shown in the income statement. (See Student Example at end.)

The practice continued until the feeling for the correct booking (posting of entries) was definitely present in the students as a skill. The principle that each amount must always be booked twice, once on the left in an account ("shall give"), once on the right ("should have"), was very helpful. An income, for example, once in the "have" of the income statement (income), a second time as an increase in value in the "shall give" of the balance sheet (assets). During a tour of an actual company, to our astonishment, even the professional accountant confessed that sometimes he only knows that, for example, a "shall give" booking has to be posted somewhere in "should have" and only then can he find out where exactly.

Founding of the company

Our "company" had the goal of earning money for the graduation trip. As usual, we wanted to achieve this through a weekly break sale. An elaborate and uncertain development of "markets" was therefore not necessary. It was also clear to everyone that we would orientate ourselves in a socially acceptable and ecological manner. The idea of offering sweets to younger students, for example, was quickly rejected: a good deal is only really good if it is good for both parties! The decision was made to sell warm, flavored apple punch and the company was named "Punsch & Co".

Regarding the “type of business": It was clear that the company would need a managing director (CEO), but no student wanted to take on this position. On the other hand, it was unthinkable to use the class teacher as an "employer" and the students as "instructor-bound employees". Management guidelines and the ultimate distribution of profits were to be decided jointly. From a strictly legal point of view, the students were addressed as "co-partners".

Start of business activity

During all these preparations, the first business transactions were already being processed, which were now listed chronologically on the board (as a "journal"): cider orders, change, accessories, donations, creation of first supplies and others. The picture was confusing; an assessment of the company's situation seemed impossible. However, a student’s objection that it was enough to keep an eye on the cash balance was already recognized as a mistake by the class at this point. In what followed, it became clear how clarifying the double-entry bookkeeping system is.

Opening the accounts took a whole lesson. The necessary accounts (books) were discussed together and then noted down by the class teacher on the blackboard and by each student in a separate notebook.

Once a week, the sales figures and other bookings were entered together, each of which took a few minutes. At the end of the calendar year (December), we prepared an initial interim report, the statements of which were eagerly awaited.

It was impressive how much the equity already formed differed from the cash balance. This is instinctively perceived as a significant asset, but this can be very deceptive. In our case, this was mainly due to the fact that the company had a lot of free capital (the advance from the teacher) on the liabilities side (debt); stocks on the assets side (assets) were formed primarily by cider stocks. At that time, the equity in the balance sheet, i. e. the value that "belongs only to the company itself", corresponded numerically exactly to the profit in the income statement. During later assessments, the students were able to experience the difference between these two values.

Company visits

In addition to working in "our own company", we also got to know real companies. First we visited some production / work rooms, then we got an insight into the bookkeeping, preferably together with the boss or the accountant.

A school father with his own bakery / café visited us in the classroom. We also visited a stonemason and a medium-sized remedy manufacturer in the region. The annual financial statements of our school association were also studied. (The visit to the offshoot of a US defence company fell victim to the corona measures in 2020.)

The accounts of the companies visited were inspected on the basis of older or expressly changed figures; anything else would have meant asking too much. The numerical proportions and the account structure were decisive.

Towards the end of the school year we were able to dissolve our "company" as planned, meet all liabilities and distribute the profits fairly.

Conclusion and evaluation

- The students were happy to take part in this lesson. For the "maths muffle" there was a new, motivating point of contact with the world of numbers. Much of the terms that had already been "picked up" from the business world could gradually be clarified.

- The bookkeeper has to meet the strict requirement of "truth, clarity and completeness of the presentation". This is of great educational value.

- Company visits: The double view of a company, on the one hand, its visible processes and on the other the accounting running in the background was enriching.

- Further questions emerged: What actually is a share? Do we want to look for investors and expand our business? What kind of demands will they have? How is the relationship between the company owner and the employees to be regulated in a human way? These questions can probably be answered at the earliest from the 9th grade, even if, of course, for many things already in the 8th grade a feeling is present. However, the knowledge of accounting offers students the opportunity to develop their objective judgment. This is certainly helpful for in-depth work in later school years.

Student voices (from a survey carried out a year later):

"The balance sheet is an important part of accounting because it gives you an overview."

"Liquid, liquid assets are that which are not invested in material, e.g. cash."

"The lessons made sense because bookkeeping is something that, unlike other school subjects, you really need in life."

"The lessons were necessary to understand what was going on in the background of companies."

"Accounting is important to understand and apply."

"I can now better understand how companies work and how you can keep an eye on your numbers."

"It was good, because now I have at least a little idea."

Further material on financial literacy is available on the website: www.associative-financial-literacy.com

About the author:

Oliver van der Waerden was born in Switzerland in 1971. After a diploma as a biodynamic farmer and several study and work experience in Africa and Germany, he trained as a Waldorf teacher in Berlin. He has been working as a teacher at the Rudolf Steiner School in Kreuzlingen at Lake Constance since 2003. He is married and has four children. He is especially interested in Rudolf Steiner's suggestions for teaching economics in the middle school.